ATTENTION: You can now pay taxes online with an ACH Debit/eCheck. Click here for more information.

County Reports

County reports include monthly redemption and sales reports, tax turnback reports, excess proceed turnback reports and recording fee reports.

Pay Taxes

Pay taxes online or request forms to pay taxes by mail.

Claim Excess Proceeds

View and claim available funds from the sale of tax delinquent property.

Public Auction Catalog

View Parcels that will be offered at public auction in the current or coming year.

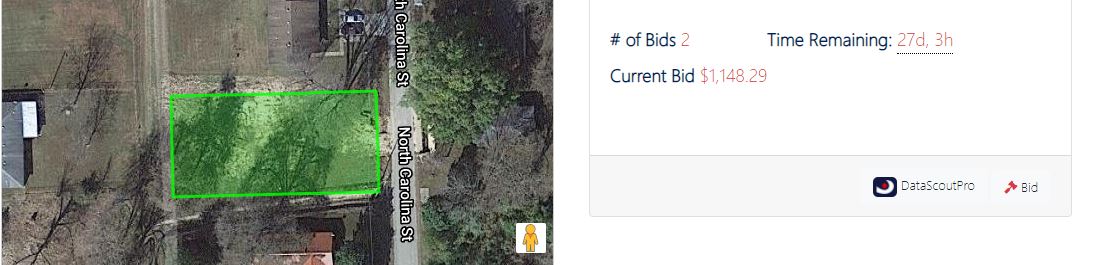

Post Auction Sales / auction.cosl.org

View and bid on parcels that are available for post-auction sale.

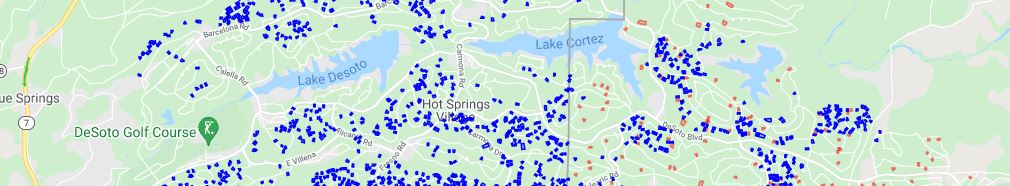

Parcel Mapping / arlands.cosl.org

View and search parcels available for sale or coming up for public auction. Also view state owned lands.